Find the right HS code for your product:

Type a product name or keywords or your HS code (e.g., 'shirt', 'domestic rabbits', '406100'):

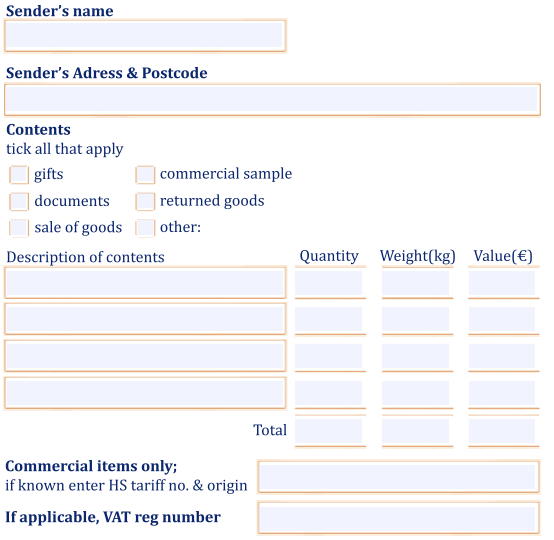

The CN22 form

As indicated, goods crossing European borders must be declared to customs. The exporter can do this by submitting a declaration. The declaration of trade items is done by means of the CN22 form, a document on which it is well described. This includes the weight, country of origin and type of goods. The CN22 customs form is for goods under two kilograms, when the merchandise is heavier than two kilograms, the CN23 document must be completed. Something that should absolutely not be missing on the CN22 form is the so-called HS code. A code that describes goods according to a whole series of categories.

CN22 example

It is important that a CN22 form can be understood worldwide. It is therefore generally accepted to submit this form in English. If the shipment is for business, it is advisable to state your VAT number in the form. This is not mandatory, because private individuals must also use this form. Once you have completed this form, it must be placed on the outside of your shipment for customs inspection.

Consequences of not applying the rules properly

When customs finds out that incorrect HS codes have been used or the CN22 customs declaration has been incorrectly completed (for example, to make use of lower import duties and therefore pay less), customs can retroactively apply the correct import duties up to three years to date. request. In other words: when wrong codes are deliberately used to save costs, this can ultimately lead to a huge sum of money that still has to be paid. So always make sure you stay sharp when exporting and importing products outside the European Union, as the rules differ per country.